Knowing what your prescription drugs cost isn’t just helpful-it’s essential. Every year, thousands of seniors face surprise bills because they didn’t check if their medication moved to a higher cost tier. That $10 copay for blood pressure pills can jump to $55 overnight if your plan changes its formulary. And it’s not rare. In 2023, nearly 1 in 3 Medicare beneficiaries saw at least one drug on their plan shift tiers without warning. The good news? You can avoid this. You just need to know where to look and what to watch for.

What Is a Drug Formulary and Why Does It Matter?

A drug formulary is simply the list of medications your insurance plan covers. It’s not just a catalog-it’s broken into tiers that decide how much you pay at the pharmacy. Think of it like a pricing ladder. The lower the tier, the less you pay. The higher the tier, the more you pay out of pocket. Most plans use 3 to 5 tiers:- Tier 1: Preferred generics-usually $0 to $10 per prescription.

- Tier 2: Non-preferred generics or lower-cost brand-name drugs-around $15 to $30.

- Tier 3: Higher-cost brand-name drugs-often $40 to $70.

- Tier 4: Non-preferred brand-name drugs that have cheaper alternatives-$70 to $100.

- Tier 5: Specialty drugs-these are often for complex conditions like cancer or rheumatoid arthritis. Costs can be $100 to $500+ per month.

Here’s the catch: the same drug can be in different tiers across different plans. For example, metformin (a common diabetes drug) might be Tier 1 on one plan and Tier 2 on another. That’s why checking your specific plan matters more than trusting what you heard from a friend.

When Do Formularies Change?

Most people think formularies only change once a year, around January 1st. That’s true for the big annual update-but changes can happen anytime. The Centers for Medicare & Medicaid Services (CMS) allows insurers to adjust formularies during the year for three main reasons:- A new generic version of a drug becomes available.

- New safety data comes out about a medication.

- A drug is no longer considered clinically effective.

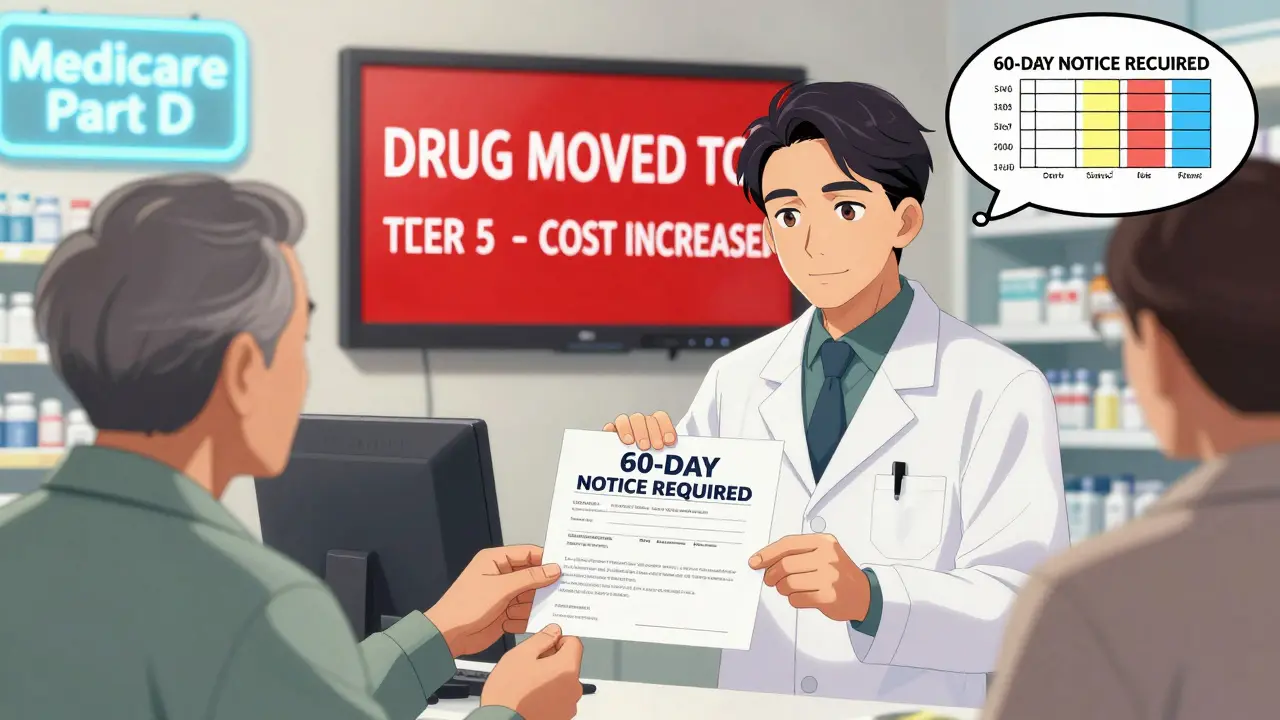

In 2023, about 17% of formulary changes involved moving a drug to a higher tier-meaning higher costs for you. The biggest trend? GLP-1 weight loss drugs like Wegovy and Ozempic are being moved into Tier 5, even when used for diabetes. That’s turned a $30 copay into a $400+ monthly bill for some seniors.

Here’s what the law says: if your drug is being removed from the formulary or moved to a higher tier, your plan must notify you in writing at least 60 days before the change takes effect. If it’s a safety issue, they can act faster-but they still have to give you a way to keep getting your medication during the transition.

How to Check Your Drug’s Tier Right Now

You don’t need to wait for a letter. Checking your coverage takes less than 10 minutes. Here’s how:- Find your plan’s official formulary search tool. Go to your insurer’s website-like Cigna, Humana, or Excellus BCBS-and look for “Drug List,” “Formulary,” or “Find a Drug.”

- Enter your medication’s name exactly as it appears on your prescription. Use the brand name if you’re unsure, then check the generic too.

- Look for the tier number and the cost: copay or coinsurance. Don’t assume it’s the same as last year.

- Check the “Restrictions” column. Some drugs need prior authorization, step therapy (try a cheaper drug first), or quantity limits.

Most plans, including all Medicare Part D plans, offer this tool online. If you can’t find it, call customer service. They’re required to give you a printed copy free of charge.

Pro tip: Use GoodRx or Medicare.gov’s Plan Finder to compare your drug’s tier across multiple plans. You might be surprised how much one plan saves you over another.

What to Do If Your Drug Moved to a Higher Tier

If your medication just jumped in cost, don’t panic. You have options.- Ask your doctor for a therapeutic alternative. Is there another drug in the same class that’s on a lower tier? For example, if your brand-name statin moved to Tier 3, ask if atorvastatin (generic Lipitor) works for you.

- Request a formulary exception. You can ask your plan to cover your drug at a lower cost if it’s medically necessary. Your doctor fills out a form explaining why the cheaper options won’t work. Approval rates range from 55% to 82%, depending on your plan and evidence.

- Use a 30-day transition supply. If your drug was removed or moved, most plans must give you at least one 30-day refill at the old price while you work out a long-term solution.

Many seniors don’t know about exceptions. In a 2023 GoodRx survey, 31% of people who faced a tier change didn’t even try to appeal. That’s money left on the table.

How to Stay Ahead of Future Changes

The best defense is a proactive habit. Set reminders:- Check your formulary every October, before Open Enrollment.

- Set a calendar alert for January 1st-this is when most changes take effect.

- Sign up for email or text alerts from your plan. They’ll notify you if your drug is affected.

- Ask your pharmacist at refill time: “Has anything changed with this drug on my plan?” Pharmacists see formulary updates daily.

Also, review your plan during Medicare’s Annual Enrollment Period (October 15 to December 7). If your current plan raised costs on your meds, switch. In 2023, 68% of Medicare beneficiaries said formulary structure was a top factor when choosing a plan-right after premium and provider network.

Where to Get Help

You don’t have to figure this out alone.- SHIP (State Health Insurance Assistance Program): Free, local counselors who help seniors understand Medicare plans. They helped over 1.7 million people in 2022.

- Medicare.gov: Use their Plan Finder tool to compare formularies side-by-side.

- Your pharmacist: They can often suggest lower-cost alternatives or help you file an exception.

Don’t wait until your prescription is denied at the counter. A 15-minute check now can save you hundreds-or even thousands-over the year.

Common Mistakes Seniors Make

- Assuming last year’s coverage still applies.

- Not checking generics-many brand-name drugs have cheaper generic versions that work just as well.

- Ignoring prior authorization requirements. If your plan says “prior auth needed,” you must get approval before filling the script-or you pay full price.

- Not asking for exceptions. Many seniors think the answer is “no” before even trying.

- Waiting until the last minute to switch plans. Some formulary changes are irreversible after December 7.

One woman in Bristol told me her husband’s diabetes medication went from $12 to $89 a month after the new year. She didn’t check until he couldn’t afford his pills. She called her SHIP counselor, found a lower-tier alternative, and saved $900 in six months. That could have been avoided with a 10-minute check in October.

How often do Medicare Part D formularies change?

Formularies update annually on January 1st, but changes can happen anytime during the year. Insurers must notify you in writing at least 60 days before a change that affects your drugs-unless it’s due to a safety issue, in which case they act faster but must still provide temporary access.

Can I switch plans if my drug is moved to a higher tier?

Yes, but only during specific enrollment periods. The main window is October 15 to December 7 each year. Outside that, you can switch if you qualify for a Special Enrollment Period-for example, if your plan drops your drug or changes its tier. You can also switch if you move out of your plan’s service area.

What if my drug isn’t on the formulary at all?

You can request a formulary exception. Your doctor must submit a letter explaining why the drug is medically necessary and why alternatives won’t work. Approval rates vary by plan but average around 70%. If denied, you can appeal. You can also ask your pharmacist for a similar drug that’s covered.

Do all Medicare Part D plans have the same drug tiers?

No. Each plan creates its own formulary within CMS guidelines. The same drug can be Tier 1 on one plan and Tier 4 on another. That’s why comparing plans before enrolling is critical. A plan with a lower premium might cost you more in the long run if your medications are in higher tiers.

Are there free tools to check drug coverage?

Yes. Medicare.gov’s Plan Finder tool lets you compare formularies across all Part D plans. GoodRx also shows tier information and cash prices. Most insurers offer free online formulary search tools on their websites. SHIP counselors can help you use these tools for free.

What’s the difference between copay and coinsurance?

A copay is a fixed amount you pay per prescription-like $15. Coinsurance is a percentage of the drug’s total cost-for example, 25%. Specialty drugs often use coinsurance, which can mean paying hundreds or even thousands if the drug is expensive. Always check which one applies to your tier.

Next Steps: What to Do Today

Right now, open your web browser and:- Go to your Medicare Part D or private insurance plan’s website.

- Search for your top three medications.

- Write down the tier and cost for each.

- Compare that to last year’s info-if you don’t remember it, call your pharmacy.

- If anything changed, call your doctor and ask: “Can we switch to a lower-tier alternative?”

Don’t wait for a bill to arrive. The cost of a single missed check can be more than the time it takes to do this. Stay informed. Stay in control. Your wallet-and your health-will thank you.

Janette Martens

December 29, 2025 AT 07:26Marie-Pierre Gonzalez

December 29, 2025 AT 11:32Louis Paré

December 29, 2025 AT 22:27Payton Daily

December 31, 2025 AT 07:37Kelsey Youmans

January 2, 2026 AT 01:11Sydney Lee

January 3, 2026 AT 06:40oluwarotimi w alaka

January 4, 2026 AT 05:30Debra Cagwin

January 4, 2026 AT 21:41Hakim Bachiri

January 6, 2026 AT 18:15