Generic substitution was meant to cut drug costs, but flawed reimbursement systems now let PBMs profit from price gaps. Pharmacies struggle to stay open, patients pay more, and transparency is still missing.

MorePBM Spread Pricing: How Pharmacy Benefit Managers Profit and What It Means for Your Medications

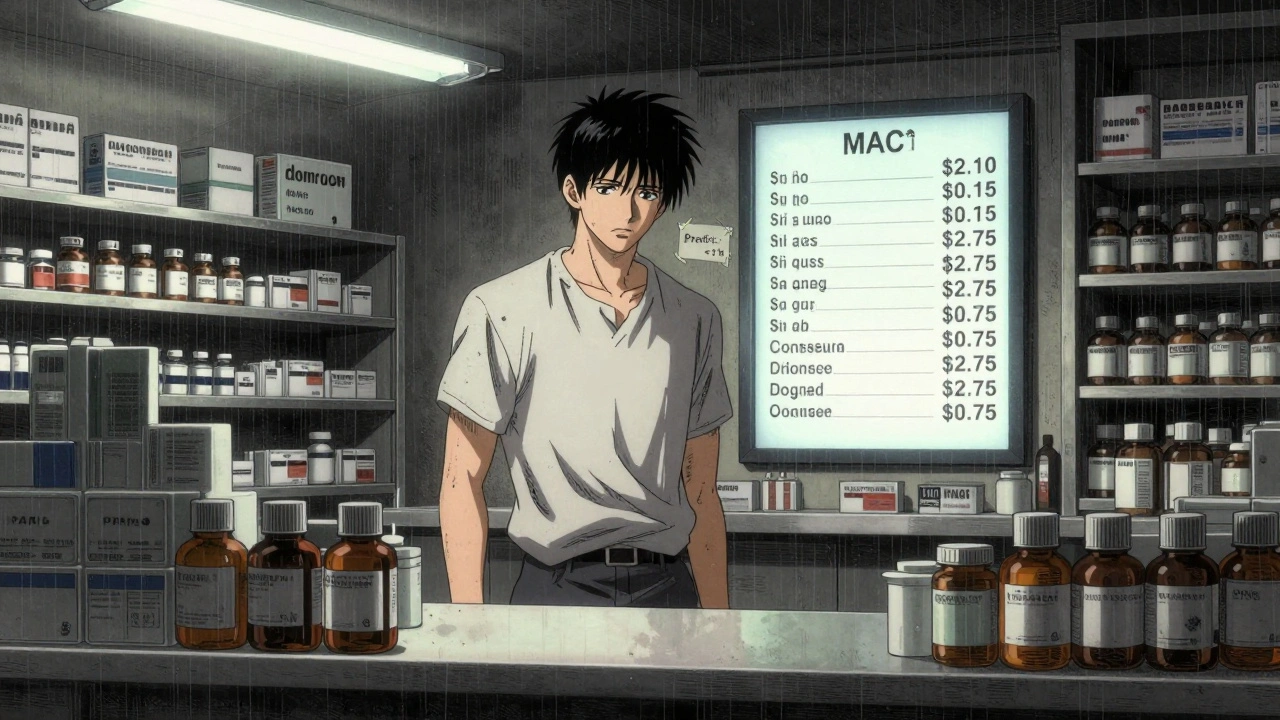

When you pick up a prescription, you might think the price you pay is what the pharmacy paid for it. But that’s not always true. Behind the scenes, PBM spread pricing, a practice where Pharmacy Benefit Managers charge insurers more for a drug than they pay the pharmacy, keeping the difference as profit. Also known as price gouging in drug distribution, it’s one of the biggest reasons your co-pay keeps rising—even when the drug’s actual cost drops. PBMs, or Pharmacy Benefit Managers, act as middlemen between drug makers, insurers, and pharmacies. They negotiate prices, manage formularies, and process claims. But instead of passing savings along, many PBMs use spread pricing to pocket the gap between what they charge the insurer and what they reimburse the pharmacy.

This isn’t just a backroom accounting trick—it affects real people. A 2023 study by the Government Accountability Office found that for some generic drugs, PBMs kept over 70% of the difference between the price they billed and what they paid the pharmacy. That means if a pill costs $2 at the wholesaler, you might pay $15 at the pharmacy, and the insurer pays $20—while the PBM pockets $5. And you’re often the one footing the bill through higher premiums or out-of-pocket costs. This system also makes it harder for pharmacies to compete. Independent pharmacies get squeezed, while big chains get better deals. And because PBMs often own their own mail-order pharmacies, they steer patients away from local stores to boost their own profits.

It’s not just about the math. Spread pricing hides transparency. You can’t see what the drug really costs. Your doctor can’t know if a cheaper alternative exists because the price they see is inflated by PBM markup. Even when generics become available, spread pricing keeps prices high to protect revenue streams. That’s why so many people end up paying more for the same drug year after year—even when the market price falls. The fix isn’t simple, but awareness is the first step. Some states are now requiring PBMs to disclose their pricing, and new federal rules are starting to crack down on these hidden markups. But until then, knowing how this system works helps you ask better questions, challenge surprise bills, and push for fairer pricing.

Below, you’ll find real-world stories and guides on how drug pricing affects your prescriptions—from how generics are labeled to why your insurance denies coverage even when the drug is cheap. These aren’t abstract policy debates. They’re the reasons you’re paying more than you should.